Sectigo HackerGuardian PCI Scan is an advanced, automated vulnerability scanning tool designed to ensure full compliance with the PCI DSS (Payment Card Industry Data Security Standard). The product was developed by Sectigo – a global leader in SSL/TLS certificates, identity management, and network security solutions – with over twenty years of experience in cybersecurity. With this solution, companies that accept card payments can quickly and effectively monitor their systems for potential threats while meeting strict regulatory requirements. Sectigo HackerGuardian PCI Scan offers comprehensive tools for automating security audits, generating compliance reports, and supporting risk management related to payment card data processing, making it an indispensable element of modern data protection strategies.

Sectigo HackerGuardian PCI Scan is an advanced, automated vulnerability scanning tool designed to ensure full compliance with the PCI DSS (Payment Card Industry Data Security Standard). The product was developed by Sectigo – a global leader in SSL/TLS certificates, identity management, and network security solutions – with over twenty years of experience in cybersecurity. With this solution, companies that accept card payments can quickly and effectively monitor their systems for potential threats while meeting strict regulatory requirements. Sectigo HackerGuardian PCI Scan offers comprehensive tools for automating security audits, generating compliance reports, and supporting risk management related to payment card data processing, making it an indispensable element of modern data protection strategies.

HackerGuardian Standard

HackerGuardian Enterprise

Why is it worth choosing HackerGuardian PCI Scan?

- Comprehensive vulnerability scanning: Performs over 30,000 automated security tests on a quarterly basis, identifying vulnerabilities in networks and systems that store or process payment card data. Automatically meets PCI DSS Requirement 11.2.2 through scans approved by the PCI Council.

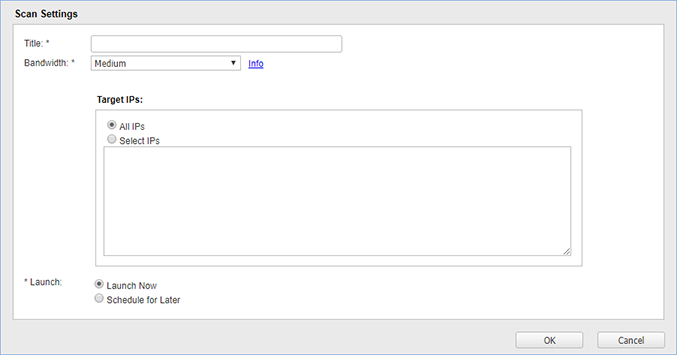

- Unlimited scan frequency: Allows an unlimited number of scans per quarter, with the Standard version covering 5 IP addresses/domains or the Enterprise version covering 20 IP addresses/domains, with options for scheduling or on-demand execution.

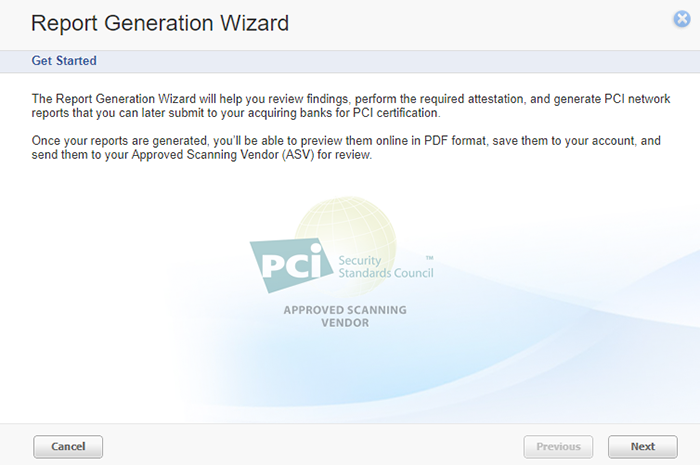

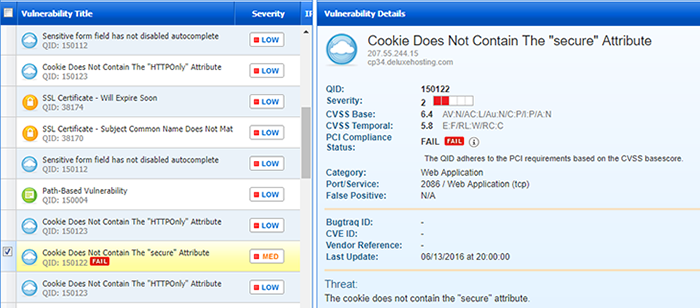

- Ready-to-use ASV compliance reports: Generates official PCI DSS reports approved by an ASV (Approved Scanning Vendor). The reports consist of two parts: a PCI Executive Report – ready to be submitted to a bank confirming the compliance status (passed/failed), and a Technical Report containing detailed vulnerability data (including CVSS ratings), remediation instructions, and risk mapping.

- Infrastructure scalability: Supports additional IP packages (up to 1,000 addresses), enabling scan scaling as the external network expands.

- Non-invasiveness: Minimizes impact on the performance of systems processing card data through optimized resource utilization.

- SaaS (Software as a Service): No need for local installation; managed via a web interface that allows scan scheduling. The web interface also serves as a central platform for result analysis, scan planning, and integration with remediation processes.

- Automation and result management: Features automatic scan scheduling and tools for verifying false positives, which accelerate the certification process. An integrated SAQ wizard automates the completion of the Self-Assessment Questionnaire, speeding up internal audits.

- Integration with the IT ecosystem: Wide compatibility with GRC/SIEM tools, connectivity with risk management platforms (e.g., Archer, RSA), and ticketing systems (e.g., ServiceNow, Jira).

- TrustMark: A verifiable security mark displayed on the website that increases customer trust.

- API and workflow automation: Integration with existing DevOps pipelines to enable continuous scanning within the SDLC.

- Cost optimization and risk reduction: Subscription-based billing eliminates the costs associated with purchasing and maintaining dedicated hardware solutions.

- Reputation protection: Minimizes fines for non-compliance with PCI DSS (up to $100,000 per month) and helps prevent loss of customer trust.

- Real-time remediation: Rapidly detects and fixes vulnerabilities, reducing exposure to attacks (e.g., SQLi, XSS, RCE).

- Corner of Trust technology: Cryptographic mechanisms ensure data integrity during scanning.

- Technological support and experience: Utilizes advanced cloud-based scanning techniques and leverages over 20 years of Sectigo’s cybersecurity expertise, ensuring compliance with industry standards.

TrustMark

TrustMark PCI DSS compliant is a designation that indicates that a given organization or IT system meets the rigorous requirements of the PCI DSS standard, which is the data security standard in the payment card industry. This certificate confirms that appropriate information protection procedures have been implemented to safeguard payment data from unauthorized access and leakage. As a result, customers can be assured that transactions conducted via the certified website or system adhere to best security practices, and that the technological solutions used—such as data encryption and monitoring systems—are regularly audited and updated. Consequently, the TrustMark PCI DSS compliant designation builds trust between users and the data-processing entities, which is crucial in an era of increasing cyber threats.

TrustMark PCI DSS compliant is a designation that indicates that a given organization or IT system meets the rigorous requirements of the PCI DSS standard, which is the data security standard in the payment card industry. This certificate confirms that appropriate information protection procedures have been implemented to safeguard payment data from unauthorized access and leakage. As a result, customers can be assured that transactions conducted via the certified website or system adhere to best security practices, and that the technological solutions used—such as data encryption and monitoring systems—are regularly audited and updated. Consequently, the TrustMark PCI DSS compliant designation builds trust between users and the data-processing entities, which is crucial in an era of increasing cyber threats.

Who needs PCI DSS compliance?

PCI DSS (Payment Card Industry Data Security Standard) requires regular vulnerability scanning of systems – primarily external scans by Approved Scanning Vendors (ASV) – for all organizations that store, process, or transmit payment card data. This includes:

- Retailers – companies that accept card payments,

- Payment processing service providers – companies that provide card transaction services,

- Other entities – banks and organizations that are part of the payment chain.

The purpose of these requirements is to ensure that systems are regularly checked for potential security vulnerabilities, thereby protecting payment card data from unauthorized access or leakage. Failure to comply with this requirement can cost organizations from $5 000 to $500 000 per month, depending on the severity of the issues. PCI scanning is not optional.

Technical Support

Technical support for Sectigo HackerGuardian PCI Scan is an extensive system dedicated to organizations that must maintain compliance with the stringent PCI DSS requirements. As part of this support, customers have access to an advanced ticketing system that enables precise classification and prioritization of reports, allowing for quick routing of issues to the appropriate specialists. The entire support framework is based on a continuously evolving knowledge base containing detailed documentation, configuration instructions, and comprehensive guides on interpreting scan results as well as best security practices. These materials are regularly updated to address dynamically changing threats and evolving security standards. An engaged team of certified IT security engineers, available 24/7, provides assistance in diagnosing system errors, optimizing scanner configurations, and implementing recommended fixes. Experts also offer advice on integrating the tool with existing security systems, such as SIEM platforms, which enables comprehensive protection of the IT infrastructure. Advanced diagnostic algorithms built into the tool automatically analyze the entire infrastructure for potential security vulnerabilities, generating detailed reports ready to be submitted to banks or payment processors. These reports not only identify critical exposure points, but also provide precise recommendations for immediate corrective action. Sectigo’s technical support further includes consultations regarding the integration of scan results with internal audit procedures and risk management systems, enabling the continuous improvement of an organization’s security strategy. Such a comprehensive support model, based on the synergy of modern diagnostic automation tools and the involvement of qualified specialists, ensures that Sectigo HackerGuardian PCI Scan meets the highest data protection standards and enables effective risk management in a dynamic IT environment.

Step 1: Start PCI scanning.

HackerGuardian makes scanning easier - simply enter your website's IP address and click ``Run Now``.

Step 2: Review and resolve any issues.

After the scan is complete, HackerGuardian will provide you with detailed information that will enable you to easily resolve any identified issues.

Step 3: Submit to your bank.

Complete the self-assessment questionnaire and submit the scan report to your bank.